报告摘要:

8月份,乘用车销量继续保持稳健增长,商用车销量下滑幅度放大。

根据中汽协公告,2014年8月,汽车销量为171.56万辆,同比增长4.04%。其中,乘用车销量为146.82万辆,同比增长8.50%,商用车销量为24.74万辆,同比下降16.36%(上月同比下降6.66%)。

8月份,SUV保持快速增长,但增速略有回落,其次是MPV。SUV销量为31.13万辆,同比增长29.63%;MPV销量14.59万辆,同比增长38.27%。不过,由于仍有部分车型由微客系列统计纳入MPV系列,数据失真明显。

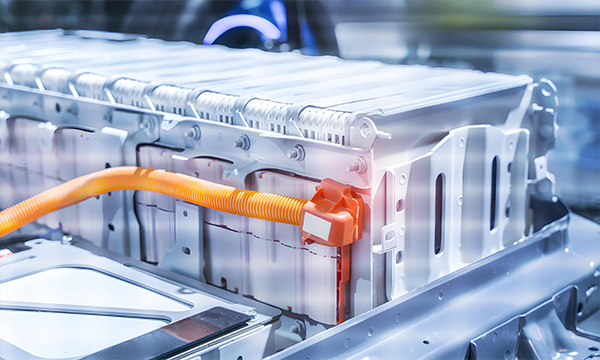

8月份,我国新能源(1418.01,0.000,0.00%)(0.00,0.000,0.00%)汽车生产5191辆,同比增长近11倍。其中,纯电动乘用车生产2447辆,同比增长近8倍,插电式混合动力乘用车生产1594辆,同比增长近27倍;纯电动商用车生产284辆,同比增长近3倍,插电式混合动力商用车生产866辆,同比增长近37倍。

我们维持汽车行业“优于大势”的投资评级。建议按下列投资逻辑选股:(1)关注新能源汽车产业链中各相关龙头企业。比如江淮汽车(0.00,0.000,0.00%)(600418)、比亚迪(0.00,0.000,0.00%)(002594)、宇通客车(0.00,0.000,0.00%)(600066)、中通客车(0.00,0.000,0.00%)(000957)、松芝股份(0.00,0.000,0.00%)(002454)、均胜电子(0.00,0.000,0.00%)(600699)、信质电机(0.00,0.000,0.00%)(002664)、万向钱潮(0.00,0.000,0.00%)(000559)等;(2)关注在乘用车行业增速稳健回升中受益明显的企业。比如长安汽车(0.00,0.000,0.00%)(000625)、上汽集团(0.00,0.000,0.00%)(600104)、华域汽车(0.00,0.000,0.00%)(600741)、一汽富维(0.00,0.000,0.00%)(600742)、海马汽车(0.00,0.000,0.00%)(000572)、悦达投资(0.00,0.000,0.00%)(600805)等;(3)关注汽车电子化智能化趋势下产业布局较早的企业。比如亚太股份(0.00,0.000,0.00%)(002284)、松芝股份(002454)、星宇股份(0.00,0.000,0.00%)(601799)、均胜电子(600699)、信质电机(002664)、宁波华翔(0.00,0.000,0.00%)(002048)、云意电气(0.00,0.000,0.00%)(300304)等。(4)关注国四标准切换布局较早的企业及相关零部件企业。比如江淮汽车(600418)、福田汽车(0.00,0.000,0.00%)(600166)、银轮股份(0.00,0.000,0.00%)(002126)等。(5)关注未来将受益于汽车后市场拓展的零部件企业。比如星宇股份(601799)、金固股份(0.00,0.000,0.00%)(002488)等。

投资风险:宏观经济环境继续恶化、汽车行业竞争进一步加剧、新能源汽车推广不力。